Digital Health Trends 2014

How will Global Healthcare Take Advantage of the Digital Trends?

Overview

Digital health revolution is happening at the convergence of healthcare and digital technology. Over the last few years, we have seen the steady increase in the roles and applications of information and communication technologies on several different parts of the healthcare system. Health information systems have become more pervasive due to increased deployment of electronic health records. Genomics and biotechnology revolution are expected to usher in next-generation medicines that are personalized.. “Big Data” revolution that is already having huge impacts in other sectors such as retail, financial services and supply chain is expected to be a big factor in healthcare. Superior analytics is expected to improve efficiency and efficacy of healthcare but today’s state of practice is varied.

Recent developments in mobile apps, social web and new category of wireless sensors embedded in devices are also expected to have significant impact on healthcare. The topic of digital health is broader and more strategic than the traditional province of the CIOs. Yet, CIO organizations can potentially play big roles in architecting the digital healthcare systems of the 21st century.

The topic of digital health is broader and more strategic than the traditional province of the CIOs.

Clearly, there is a lot of excitement. But there is also a lot of confusion and there are serious challenges. There are countless examples of isolated cases in different parts of the world but systematic assessment of the economic returns from investments in digital technologies have not yet been forthcoming. Regulatory policies regarding privacy and security of health data are often piecemeal and inconsistent within- and across- countries.

You -- as astute students in management -- are invited to provide your insights in the form of frameworks that organize the complexity, prioritizes the key trends that could drive actions within pharmaceutical companies in general and Merck in particular.

We have provided six trends as starting points. You should feel free to add others to the list and/or recombine them into more meaningful set of trends as you develop your own analysis and derive insights and recommendations for Merck.

EMR, Health Records, Big Data

1. From Electronic Medical Records, Personal Health Records to Big Data

Over the last decade, major healthcare providers have undertaken efforts--of differing scale and scope--to digitize their records within the hospitals. Electronic Medical Records (EMRs) are digital capture of the detailed information within clinics, hospitals and doctors’ offices that allow for enhanced efficiency, accuracy and analysis. Personal Health Records (PHRs)--on the other hand--are the same type of information but focused on a single patient that is most often managed by patients. Individual patients now are able to integrate multiple types of data--including data from home monitoring devices and mobile apps--and securely store them on the cloud enabled by services from companies such as Microsoft, Box, EMC and others (who are making their services compliant with HIPAA).

Big Data is the new big trend in healthcare. Many expect really big payoffs from big data but key challenges still remain to achieve this potential.

Big Data is already the subject of major moves in digital health. Take a look at some of the moves as big data becomes mainstream.

You have doubtlessly come across other companies that are in play as attractive candidates for acquisitions or alliances due to their deep technical capabilities with big data and analytics. At the same time, healthcare organizations cannot simply become best at using ‘big data’ overnight by acquiring or allying with smaller, smarter companies or enter into business agreements with leading service providers such as IBM or Accenture.

Many senior executives recognize the potential importance of ‘big data’ but wonder if the broader healthcare system is ready to embrace this trend now, given the slower implementation of EMRs and less dramatic adoption of PHRs. Is ‘big data’ ready for prime time? What’ the road map of value creation from big data in healthcare? Who are the likely winners in the healthcare sector with big data? What sectors--beyond healthcare--provides useful benchmarks and lessons for Merck?

Mobile Applications

2. Road Map for Mobile Apps

Ever since Apple introduced the iPhone in 2007, and Google followed suit with Android in 2008, apps on mobile devices have become integral to how consumers and enterprises live, work, play, learn, transact and innovate. Mobile apps--now number over a million each--on Apple’s App Store and Google Play. Healthcare apps are becoming more common for individuals to monitor vital signs and are likely to be important facets of the digital transformation of healthcare globally by 2020 if not sooner.

IMS Health

is the World’s leading information services company. IMS Health sees enhanced and pervasive role for mobile apps in healthcare system--evolving from the current state of novelty into mainstream. According to their 2013 study.... More »

Mobile apps--even in the current rudimentary state--show the potential to be central to serious and sustained engagement and interactions amongst various key players in the health ecosystem. There is a growing list of Apple iTunes Medical Apps and Google Play Medical apps.

We are already beginning to see apps for different therapy areas such as diabetes (examples: Daily Carb App, Glucose Buddy, & Go Meals by Sanofi-Aventis), oncology (examples: Dr K’s Breast Checker; PCR Tracker; & SkinKeeper) or nervous systems (examples: Noteness; Parkinson Diary; & Young Epilepsy).

The wide variety of apps can be positioned along the patient journey from prevention/healthy living to self diagnostics to finding a physician to education/post-diagnosis to filling prescriptions to compliance (as an illustrative process suggested in the IMS Report). Or, you may develop your own categorization of the roles and functionality of mobile apps today and possible roles in the future as technology developments in hardware and software allow for enhancing mobile health apps. Dr. Erik Topol MD, a practicing cardiologist at Scripps Clinic said in an interview that he prescribes more apps than pills. Clearly, he is a pioneer and innovator. Will other doctors follow? when? why?

Beyond consumer-oriented apps that are available for download from Apple or Android app stores without prescriptions, we are now entering an era of prescription-only smartphone apps. BlueStar is a smartphone app that helps diabetics track their glucose readings, analyzing patients’ blood glucose readings and then coaching them on medical and behavioral changes required to minimize the impact of the disease. Since BlueStar goes beyond providing information--it actually gives recommendations on the doses and timing of diabetes medications--it falls under the purview of FDA in the US. The physician designs the diabetes care and the app helps the patient adhere to the prescribed care. This app is expected to be rolled out in USA during 2014. WellDoc--the company behind BlueStar mobile prescription therapy-- received venture funding from Merck Global Health Innovation Fund in January 2014.

Today’s functionality with mobile apps is limited--with most medical apps focused on providing information with some apps allowing for recording of simple health and wellness data. What’s your representation of the roadmap for mobile apps in healthcare? What new functionality are possible given enhanced technical features added into smartphones? Who should mind the medical app stores? What sectors--outside healthcare--provide useful benchmarks and insights for Merck?

Wearable Technology

3. Wearable Computing and Next-Generation Healthcare Devices

Wearable computing is a hot trend in 2014. Activity monitors, heart-rate monitors, and pedometers are some of the most common devices. New form factors are emerging in the shape of wristbands, watches, clothing, and accessories. Fitness enthusiasts love to track movement, vitals, body temperature, sleeping patterns, and speed and companies such as Nike (FuelBand), UnderArmor (with MapMyFitness), Jawbone (UP) and others are innovating with new devices and services.

Beyond these three examples, we are beginning to see devices that allow patients and physicians to get medical-grade healthcare data. Take a look at some of the examples below as starting point . Then, you may do your own additional research to understand the scope and timing of impact of wearable computing and next-generation computing devices on healthcare.

Beyond these nine examples, you may have come across innovations in wearable technologies that could be applicable in different cases and settings in various parts of the world. Some of these work on proprietary platforms while others work on established platforms provided by Apple, Google and Microsoft. Indeed, Microsoft’s HealthVault lists 200+ devices on its platform. Microsoft’s HealthVault Connection Center software allows individual patients to add data from the approved devices to HealthVault account. This software works with health and fitness devices connected to computer such as: blood pressure monitors, heart-rate monitors, blood glucose monitors and others.

Google Glass in Healthcare

One of the widely anticipated new product launches this year is Google Glass. There are several different applications for Glass today and many more are expected to be designed and developed in the coming years. But, specifically, what could Google Glass do for enhancing healthcare? Dr. John Halamka, CIO of Beth Israel Deaconess Medical Center in Boston speculated on possible use cases in his blog post on July 16, 2013 after testing the Glass with uses for clinical documentation, emergency management dashboards, alerts and reminders as well as decision support.

This video shows a prototype that Accenture and Philips Healthcare have created to demonstrate the potential. Clearly, we are in the early stages of exploring the full gamut of opportunities with Glass. Initiative such as Glassomics--the world’s first research collaborative exploring wearable computing applications in medicine--is based on the promise of Google Glass and related technologies.

Wearable computing and next-generation devices are expected to play key roles in the digital transformation of healthcare. But key questions remain--will these devices go beyond narrow segments of adoption? Could applications based on innovations such as Google Glass and Samsung Smartphones go beyond periphery of healthcare and become mainstream? What could Microsoft do to position HealthVault at the core of digital health? But, more importantly, what do wearable computing and next-generation healthcare devices mean for pharmaceutical companies such as Merck? Will this allow for better understanding of efficacy of different medications?

Social Web and Collaboration

4. Social Web for Comfort and Collaboration

Social web has grown in importance, popularity and usage thanks to Facebook, LinkedIn, Google + and others. Beyond consumer-to-consumer interactions, such networks also allow for professional-to-professional connections as well as company-to-consumer connections. McKinsey & Co. expects that the value from the social economy is still very much untapped and that much could be gained through using social tools to enhance communication, share knowledge and collaborate across different organizational and geographical boundaries. McKinsey estimates that full implementation of social tools could increase the productivity of knowledge workers by 20-to-25 percent.

McKinsey Report: Social Economy:

In a few short years, social technologies have given social interactions the speed and scale of...

Mayo Clinic Center for Social Media has complied a list of how different healthcare institutions use social media. In healthcare, two types of social web are important. Patient networks and physician networks.

Patient Networks

Patients Like Me

co-founded in 2004 by three MIT engineers: brothers Benjamin and James Heywood and longtime friend Jeff Cole. Five years earlier, their brother and friend Stephen Heywood was diagnosed with ALS (Lou Gehrig’s disease) at the age of 29. The Heywood family soon began searching the world over for ideas... More

I Had Cancer

whose “mission is to empower anyone who has been affected by cancer. Whether you are a fighter, survivor or supporter/caregiver, you can find the support and answers you need from people who have experienced similar situations”

Crohnology

Crohnology is a patient-powered research network that allows any patient to contribute to the research for the cure. Are such networks potentially extendable and scalable?

Physician Networks

Sermo

Sermo is passionate about the potential of social media on healthcare. It is arguably the largest online community of physicians with over 200,000 licensed and verified doctors. Sermo’s goal is... More

Doximity

another large medical network that boasts 1 in 3 US Physicians as members. It was founded by Jeff Tangney in 2011 and is based in San Mateo, California in Silicon Valley. Interestingly, it is working with Cleveland Clinic to replace classroom... More

Ding Xiang Yuan

The Chinese version of the physician network is called DXY (the Chinese name is Lilac Garden)--where physicians interact to gain insights from colleagues and discuss new clinical findings. It is reported to have more than 3.2 million physicians as members.... More

Gamification

Gamification has emerged as a key sub-trend within social web in health for its potential to engage patients and motivate them to maintain their routines through peer pressures and social pulls and tugs. According to Jane McGonigal at the Institute for the Future, humans spend about 3 billion hours weekly playing computer games and that the gaming addiction and behavior could be put to productive use. American Journal of Preventative Medicine reported the results of a study of gaming: “video games improved 69% of psychological therapy outcomes, 59% of physical therapy outcomes, 50% of physical activity outcomes, 46% of clinician skills outcomes, 42% of health education outcomes, 42% of pain distraction outcomes, and 37% of disease self-management outcomes.” PSFK Labs has a summary of its report on SlideShare.

Below, we have provided some experimentation underway to design and deploy games to enhance patient engagement.

Social web has gained acceptance and importance in many sectors but not as much within healthcare. Patients-like-Me and Sermo are initial experiments. What roles could social web (including gamification) play for patients and physicians in the near future? What roles should pharmaceutical companies play to tap into the power of such social networks? Who could be key strategic partners for Merck in this domain?

3D Printing

5. 3D Printing and Digital Health

3D printing (formally labeled as “additive manufacturing”) is a process of making three dimensional solid objects from a digital model. 3D printing is achieved using additive processes, where an object is created by laying down successive layers of material. 3D printing is usually performed by a materials printer using digital technology. Over the lat decade, there has been steady increase in the sales of 3D printers with impressive reduction in prices.

You may have heard of 3D printing in areas such as jewelry, footwear, industrial design, architecture, engineering and construction (AEC), automotive, aerospace, dental and medical industries, education, geographic information systems, civil engineering, and many others. But, 3D printing in healthcare? What’s the potential? What are the key bottlenecks?

Now, let us glimpse into the future through Organovo -- a start-up company focused on the design and creation of “functional human tissues using proprietary three-dimensional bioprinting technology.” Their goal was to “to build living human tissues that are proven to function like native tissues. With reproducible 3D tissues that accurately represent human biology, we are enabling ground-breaking therapies by:

- Partnering with biopharmaceutical companies and academic medical centers to design, build, and validate more predictive in vitro tissues for disease modeling and toxicology.

- Giving researchers something they have never had before: the opportunity to test drugs on functional human tissues before ever administering the drug to a living person; bridging the gulf between preclinical testing and clinical trials.

- Creating functional, three dimensional tissues that can be implanted or delivered into the human body to repair or replace damaged or diseased tissues.

The Economist March 8, 2014 issue (Technology Quarterly) had an extensive discussion on Bioprinting as a good reference. This particular section is interesting in the context of 3D printing in digital health:

In other less ambitious domains of healthcare, 3D printing could prove effective in the short-term. Customized insoles for shoes are now possible through the use of 3D printed processes from Sols using smartphones such as Apple iPhone.

Dental professionals have begun to use 3D printing to create bridges and crowns using oral scanning and CAD/CAM software, thereby reducing the wait time but also the cost.

Customized orthopedic implants not only reduces surgery time but also generally perform better. Already, a significant number of hearing aids are manufactured using 3D printing--where the benefits include better fit for the patients and reduced inventory and transport costs.

Robohand--a new startup is focused on creation and provision of mechanical devices--offers hints of potential of 3D printing machines from Makerbot for wider use in war-torn areas of Africa.

Fripp Design and Research in the UK worked with Manchester Metropolitan University to create 3D printed prosthetic eyes. Late November 2013, the company announced that it had the capacity to make 150 eyes per hour--thereby making this technology deliver prosthetic eyes to patients in parts of the world where poorer patients historically could not afford prosthetic eyes.

The Mayo Clinic has started using 3D printing to customize new hips for patients with severe impairments where standard hip replacement surgery might not provide maximal relief.

3D printing may sound like science fiction but the early results are encouraging. What’s the road map for widespread adoption of 3D printing within healthcare? Where are the opportunities for Pharmaceutical companies such as Merck? Where are the key areas of threat? Who could be key strategic partners for Merck in this domain?

Watson

6. Cognitive Computing and the Future Role of Dr. Watson (from IBM)

Vinod Khosla of Khosla Ventures wrote in Fortune (December 2012) that “Eventually, computers will replace 80% of what doctors do and amplify their capabilities.” The broader context for his statement is below.

Much of what physicians do (checkups, testing, diagnosis, prescription, behavior modification, etc.) can be done better by sensors, passive and active data collection, and analytics. But, doctors aren't supposed to just measure. They're supposed to consume all that data, consider it in context of the latest medical findings and the patient's history, and figure out if something's wrong. Computers can take on much of that diagnosis and treatment and even do these functions better than the average doctor (while considering more options and making fewer errors). Most doctors couldn't possibly read and digest all of the latest 5,000 research articles on heart disease. And, most of the average doctor's medical knowledge is from when they were in medical school, while cognitive limitations prevent them from remembering the 10,000+ diseases humans can get.

Computers are better at organizing and recalling complex information than a hotshot Harvard MD. They're also better at integrating and balancing considerations of patient symptoms, history, demeanor, environmental factors, and population management guidelines than the average physician. Besides, 50% of MDs are below average! Computers also have much lower error rates. Shouldn't we take advantage of that when it comes to our health?!

Technology compensates for human deficiencies and amplifies our strengths – MDs and less-trained medical professionals can do more. Eventually, computers will replace 80% of what doctors do and amplify their capabilities.”

A longer, updated version (still in draft form) is available.

Enter IBM Watson

Named after IBM founder Thomas J. Watson, IBM Watson was developed in IBM’s Research labs. Using natural language processing and analytics, Watson processed information akin to how people think, representing a major shift in an organization’s ability to quickly analyze, understand and respond to Big Data. Watson’s ability to answer complex questions posed in natural language with speed, accuracy and confidence was transforming decision making across a variety of industries. A brief overview of IBM Watson can be found here.

According to IBM:

“Watson is a cognitive technology that processes information more like a human than a computer—by understanding natural language, generating hypotheses based on evidence, and learning as it goes. And learn it does. Watson “gets smarter” in three ways: by being taught by its users, by learning from prior interactions, and by being presented with new information. This means organizations can more fully understand and use the data that surrounds them, and use that data to make better decisions.”

IBM fundamentally believed that Watson could be a game-changer in healthcare. According to IBM, “only 20 percent of the knowledge physicians use to make diagnosis and treatment decisions today is evidence based. The result? One in five diagnoses are incorrect or incomplete and nearly 1.5 million medication errors are made in the US every year. Medical decision making continued to increase in complexity, and health care providers were pressed to find new methods of addressing the related challenges.

How does Watson work in healthcare? According to IBM:

a physician can use Watson to assist in diagnosing and treating patients. First the physician might pose a query to the system, describing symptoms and other related factors. Watson begins by parsing the input to identify the key pieces of information. The system supports medical terminology by design, extending Watson's natural language processing capabilities.

Watson then mines the patient data to find relevant facts about family history, current medications and other existing conditions. It combines this information with current findings from tests and instruments and then examines all available data sources to form hypotheses and test them. Watson can incorporate treatment guidelines, electronic medical record data, doctor's and nurse's notes, research, clinical studies, journal articles, and patient information into the data available for analysis. Watson will then provide a list of potential diagnoses along with a score that indicates the level of confidence for each hypothesis. The ability to take context into account during the hypothesis generation and scoring phases of the processing pipeline allows Watson to address these complex problems, helping the doctor — and patient — make more informed and accurate decisions.”

Clearly, some healthcare companies have rushed to work with IBM Watson. They include: MD Anderson Cancer Center in Houston, WellPoint for pre-approval decisions using evidence-based learning and Sloan-Kettering Cancer Center for advancing personalized cancer-care.

More recently at the 2014 Mobile World Congress in Barcelona, Ginny Rometty, CEO of IBM called upon the leading mobile developers to integrate Watson’s cognitive computing capabilities. Watson Mobile Developer Challenge could provide useful next-generation apps for healthcare.

Cognitive computing--despite its infancy--could drive big shifts in healthcare. Today’s pilots are focused experiments to understand the myriad of technical and organizational challenges in making it work as part of knowledge-intensive work practices. While IBM has led with Watson, there will be other offerings in the near future. What could this mean for the future of healthcare and pharmaceutical companies? What should Merck do--if any--regarding cognitive computing?

Ecosystem

7. Other Major Strategic Players To Watch in Digital Health Ecosystem

Digital health ecosystem is rapidly evolving with many established players in the information technology domain jockeying to influence the future of healthcare. In addition to the companies mentioned above, there are several others that could be important players in the digital transformation of healthcare.

GE

GE’s focus on Industrial Internet is about bridging the industrial infrastructure and silicon valley and healthcare sector is an important part of it. According to GE: “Industrial machines have always issued early warnings, but in an inconsistent way and in a language that people could not understand. The advent of networked machines with embedded sensors and advanced analytics tools has changed that reality. For the first time in history, remotely distributed machines across the globe – from MRIs to wind turbines to aircraft engines – can be monitored in real time, unlocking the language of machines and opening tremendous benefits. Collecting and sifting through these bits of information unlocks new insights into how we can more efficiently and economically run our global economy.” GE believes that about $100 billion of the nearly $750 billion wasted (inefficiency) in healthcare could be eliminated by Industrial Internet. Its “Healthymagination” initiative already has important mobile apps with more developments underway.

Cisco

Cisco’s focus on telepresence has application in healthcare. Labeled as HealthPresence, Cisco expects to play a central part in delivering healthcare across distance. According to Cisco: “Using the network as a platform, Cisco HealthPresence software integrates high-definition video, advanced audio, third-party medical devices, and collaboration tools. The software is a conduit, transmitting unmodified medical information end to end, helping to enable convenient access to efficient, high-quality patient care and clinical collaboration across any distance.”

AT&T

The global telecommunications giant, AT&T is positioned to deliver mobile health and related services and solutions. According to AT&T: “We understand the various gaps in healthcare today, and have developed solutions to help address them. AT&T ForHealth solutions can help solve these challenges along the entire continuum of care — from acute care settings to home care settings. AT&T ForHealth was created to accelerate the delivery of innovative wireless, cloud-based and networking services and applications to help the healthcare industry improve patient care and reduce costs... These innovative solutions are focused on improving collaboration among providers, patients and the whole healthcare team — leading to a more integrated approach to healthcare delivery. We believe an integrated care model with fewer opportunities for gaps in coordination will help improve outcomes for everyone who touches the healthcare system. Whether it's our cloud-based solutions, health information exchange, mHealth or telehealth solutions, we're bridging the gaps in healthcare today.” More recently, in february 2014, AT&T appointed Dr. Eric Topol as the New Chief Medical Advisor.

Samsung

The Korean electronics giant has shown its commitment to digital health with major sponsorship of the Center for Digital Innovation at University of California at San Francisco in February 2014. Its flagship Galaxy smartphone already has apps focused on fitness as also its smart watch labeled as Galaxy Gear. Clearly, health is an important focus for Samsung--whose tablets, laptops and other medical diagnostics equipment (under the name Medison) are used in various healthcare facilities.

Qualcomm

QualcommLife--part of the Qualcomm Company--has designed and deployed the 2net platform. Its vision is “to be universally-interoperable with different medical devices and applications, enabling end-to-end wireless connectivity while allowing medical device users and their physicians or caregivers to easily access biometric data...”

Nintendo

In a corporate presentation in January 2014, the CEO emphasized the importance of health and Quality of Life (QOL) as key to its future. His focus was on consumer engagement--where Nintendo’s historical core competence in designing and delivering compelling games that captured players’ attention could be extended to healthy living.

Venture capital for digital health

There has been a lot of recent attention in Silicon Valley and elsewhere focused on digital health. The presentation from Rock Health provides a good summary of the 2013 trends.

Rock Health is one of the focused companies in the digital health space to accelerate disruption and innovation with an impressive set of corporate partners such as GE, UnitedHealth, Kaiser Permanente, Kleiner Perkins (KPCB) and Fenwick. What role could silicon valley play in the future of digital health and what should pharmaceutical companies do to systematically tap into digital innovation beyond passive investments?

You are encouraged to add other companies that you believe could play critical catalyst roles in the digital transformation of the health sector.

Your Task

By now, you realize that digital health is both exciting and challenging. Digital health trends have different implications to different players in the complex healthcare system. Some trends are more relevant and immediate to hospitals and insurance companies and less so for biopharmaceutical companies. Some trends are more relevant to western consumers but not for others. At the same time, we can see how the trends discussed above plus other trends you may identify could potentially disrupt and transform the global healthcare system. Recent innovations in mobile, social and cloud show possibilities across geographies and demographics.

You are presenting your point of view to Merck executives--charged with the responsibility to analyze potential impacts of digital disruption, innovation and transformation over the next five years, till 2020.

-

Review the six trends discussed above as starting point.

Add other trends that you believe complement the above set. You can either keep them as given or recombine them to make them more meaningful as these trends are clearly interdependent and dynamic. -

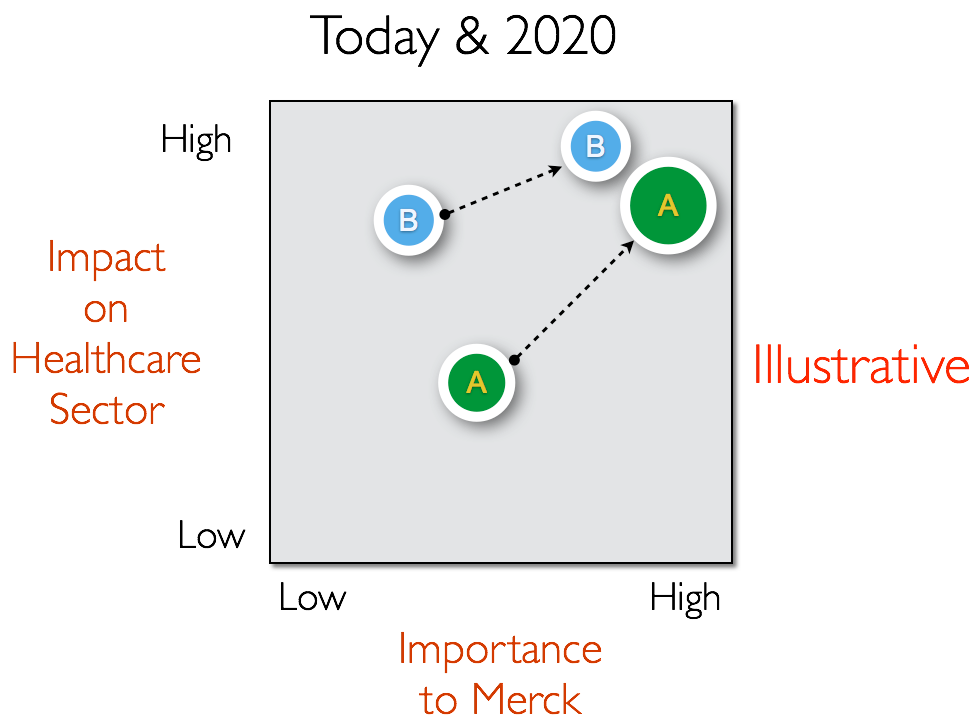

Map the trends on the following matrix.

The vertical axis is the impact on healthcare system as a whole. The horizontal axis is importance to Merck. It is possible that some trends may be important to other parts of healthcare system but may not impact Merck’s business. Mapping the trends on this matrix reflects and positions your distinct point of view. Map the trends today and 2020 to show the relative movement along the trends. Focus on global healthcare sector or specific regions in the world as you feel comfortable. Be explicit with your assumptions. -

Select TWO trends that you have placed on the upper right of the matrix in the year 2020.

For each, develop your point of view that covers some of the following questions.

- Why is it important to Merck? How big is the impact over the next 5 years? 10 years? Does it offer new opportunities or pose threats to current business model of Merck?

- What should Merck do specifically in response to this trend? Here, be precise with your advice.

- What technological developments or market moves should Merck track?

- What other sectors--beyond healthcare--offer useful insights for Merck with these trends?

Your presentation should be compelling and persuasive on the importance of the two trends for Merck and supported by specific actions to effectively respond to them in the near future as they position for 2020 and beyond.

The 2014 Business Challenge in Digital Health was prepared by professor N. Venkat Venkatraman, David J. McGrath Jr. Professor in Management at Boston University Questrom School of Business in collaboration with Merck.